If the coronavirus crisis is a uniquely human crisis, the most powerful driver in our economic recovery is what we do next with our human capital and people practices.Research and recent discussions from our Human Capital Investment and Reporting Council (HC IRC) suggest that an enhanced focus on human capital reporting, transparency and disclosure is an important foundation for action by a community of stakeholders.

If the coronavirus crisis is a uniquely human crisis, the most powerful driver in our economic recovery is what we do next with our human capital and people practices.Research and recent discussions from our Human Capital Investment and Reporting Council (HC IRC) suggest that an enhanced focus on human capital reporting, transparency and disclosure is an important foundation for action by a community of stakeholders.

Here are a few issues we see as central to economic recovery.

- The Coronavirus crisis is above all a human crisis requiring people centric measurement and solutions.

As the crisis began, our members reported intense crisis management activity to protect their workforce and follow social distancing guidelines. Many assembled location, health, wellness, and safety data in rapid succession. They moved employees to work from home and focused on virtual technology skills. Organizations identified “essential” workers – those on the front line or in service and defense industries – and provided critical “PPE” (Personal Protective Equipment).

For most, a new primary focus emerged on the health and welfare of the workforce with front line worker support, virtual communications, digital technologies, employee engagement, leadership communications, and social listening practices. Executives worked overtime to build capability and workforce protections. We shared workforce response data like that of Just Capital’s COVID-19 Corporate Response Tracker1 to benchmark and guide workforce support in areas like paid sick leave, health and safety, bonuses, and community support.

- Everyone is doing workforce planning in the “pandemic” scenario, whether they know it or not – and workforce data is front and center.

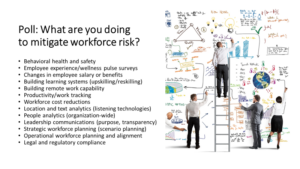

Many companies reported an intense step up in their workforce planning with COVID related modeling and scenario planning. Some are in survival mode requiring significant workforce reductions. Others have pledged no workforce job loss, while modeling cost and staffing shifts. Nearly all are doing scenario planning tied to COVID-19, staffing and expense reduction. Workforce health and welfare data is being requested by Boards and CEO’s, as companies continually reassess their workforce and adjust to evolving business realities.

Companies are focusing more on skills. A healthcare HR exec explained the need to re-configure teams based on critical skills in a hospital system. “To fill an ICU, we looked for skills and built the teams from internal resources rather than filling jobs.” With talent scarce, companies are focused on skill identification, skill gaps, and building needed capabilities.

- Without human capital risk planning, investors, policy makers, and corporate executives are flying blind.

Human capital risk planning is a new focus for many companies, a topic we’ve covered in two recent meetings2. Recent market volatility demonstrates investor uncertainty about many things, including workforce risks and investors’ trust in future organizational response.

Organizations disclosing more about their human capital have historically performed better in the market, research3 suggests. But reliable, validated human capital reporting has long been a black hole for investors, including institutional investors representing employee pension funds. This may change, as investors and policy makers press for insightful evidence of risk mitigation and future sustainability.

The SEC has supported the move to enhanced disclosure and a focus on workforce health and welfare. “We recognize that producing forward-looking disclosure can be challenging and believe that taking on that challenge is appropriate” explained the SEC in an April letter4.

- The road to recovery is about evidence and accountability for results.

“Testing, testing, testing,” has been the mantra for COVID-19 health recovery. Shifting accountability for testing has limited the effectiveness and speed of response. Similarly, workforce health and safety data and clear accountability will be needed to “awaken the patient from the coma,” as one member described it.

What evidence is available – and more importantly, who is accountable? Will senior teams take accountability? Will HR? Will line managers? Or will some combination of aligned partnership be required to make investments and decisions to take action?

Finally, what evidence will be available to policy makers and investors? And what will be their accountability? Which organizations will be ready for the scrutiny that comes with public and private investments and restructuring? The social and political issues tied to accountability remain big unknowns.

- Reliable human capital data is often lacking yet the raw data is readily available, along with proposed ISO HC reporting guidelines.

The enhanced usage of people data and analytics has been a positive business trend long before the COVID-19 crisis. But stakeholders, including executives and investors, have not always had value relevant and decision useful information5.

Turning people data into decisions requires skill, effort, discipline and budget lacking in many strapped HR departments. Priorities have often been elsewhere in building employee engagement and experience metrics, along with other “hot” technology driven vendor offerings.

Even experts acknowledge that the value of human capital is not always easy to measure. Nevertheless, ISO guidelines do exist for internal and external human capital reporting. Until now, relatively little has been offered publicly in most U.S. companies.

“We may not always want to know what the data tells us,” said one member. As we have seen with the COVID-19 crisis “not wanting to know what the data tells us” can be a recipe for disaster, and certainly not one that leads to economic recovery.

- The need for transparency has never been greater.

Many of the critical metrics and practices needed most are not transparent to the very stakeholders, such as employees, investors and government policy makers, who must partner to start and sustain the economy recovery.

Moving forward, enhanced transparency around workforce management and human capital measures will be needed. Without such data, organizations will have a difficult time adapting to changing markets and workforce needs and building critical partnerships. Such data is critical to building workforce trust and to attracting, engaging and retaining talent.

Increasingly, as organizations collect more data about their workforce, employees want to benefit from that data. “We saw less concern about privacy, when we saw the workforce data was shared and being used to protect the workforce,” said one member. Privacy and ethical use of people data are critical. But a key question is, does your workforce benefit from your people data and does it build trust?

- Investing in and developing the workforce has never been more important.

The power of learning, development and people investment has never been greater nor more directly tied to economic results. A greatly changed world requires a new level of learning investment, adaption and innovation.

Will organizations see the need for learning investment and people development as a continuing need? Will they measure it to better manage it? Will they begin to see human capital measures as a means for learning about what’s working and what’s not? Will they begin to see human capital reporting as a leading indicator of recovery? How we invest in people now will determine our future success.

- The healing power of community and connection.

Our Council recently prioritized the measure of company culture as one of the most critical metrics. Research has long shown that a positive company culture leads to engaged employees which will increase productivity and business results.

But what the current crisis has also exposed is hunger for communities that share purpose and values – the glue that holds people together. As we heal from the COVID-19 pandemic, the power of human connection and community may be the greatest healer available as new relationships and partnerships build a better future.

The Human Capital Investment and Reporting Council is an executive peer group of human resource, investor and finance community members who sponsor relationship building forums and learning, conversations, research, and solutions on workforce measurement, management, reporting, and investment. Due to confidentiality requirements, Council members are not identified.

Resources

1: https://justcapital.com/reports/the-covid-19-corporate-response-tracker-how-americas-largest-employers-are-treating-stakeholders-amid-the-coronavirus-crisis/

2: https://www.linkedin.com/in/ameliaarmitage/detail/recent-activity/posts/

3: https://www.epic-value.com/

4: https://www.sec.gov/news/public-statement/statement-clayton-hinman

5: https://www.cfo.com/financial-reporting-2/2020/04/virus-lays-bare-corporate-reporting-debate/