Author’s Note: Greg Swick, Chief Sales Officer, and Jody Kaminsky, Chief Marketing Officer, both of Ultimate Software, were interviewed and contributed to this article.

Representing the largest merger of employees and shared customers in the HCM market in over a decade, the merger agreement by Ultimate Software and Kronos sets an aggressive pace for HCM market growth and opportunism in the decade ahead. Both Ultimate and Kronos have enjoyed strong financial performance and steady growth, but the two workplace software companies, or more specifically their owners Hellman & Friedman, could not ignore the potential synergies that will lead to a combined enterprise value around $22 billion. Led by Kronos CEO, Aron Ain, the combined workforce of the new company has over 12,000 employees jointly headquartered in Lowell, Massachusetts and Weston, Florida. Despite the lofty numbers for employees, revenue, and customers, the significance of this merger is not in the digits versus the employee value proposition supported by both solutions.

Aron Ain, CEO of Kronos and Ultimate explained the impact this union will have on the global HR landscape. “We have successfully completed a merger like no other. While today is a very proud day for Kronos and Ultimate – and for me as the very grateful CEO of our combined company – we temper our excitement with respect for the turbulence happening in our world right now. This unprecedented situation has already shown our new company’s colors. Teams at both Kronos and Ultimate are collaborating beautifully to ensure we continue to support our customers while prioritizing the safety of our employees, colleagues and our collective communities.”

THE DEAL

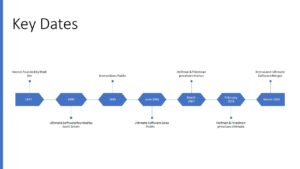

Before focusing on the grand forecasts proposed through the realization of this combined company the economics of this deal are significant and merit review. Hellman & Friedman, the private-equity firm, paid about $11 billion last year to take Ultimate Software private and previously bought Kronos in 2007 in a transaction valued at roughly $1.8 billion (The timeline of organizational transition for Kronos and Ultimate Software is captured in Figure 1). The combined company targets $3 billion in annual revenue, and there are significant opportunities for growth as only 400 companies are presently mutually shared. The strength of these two companies enable their leadership to forecast additional employee growth of 3,000 people over the next three years and continued product optimization of solutions in the human capital management and workforce management space. Kronos has been an established leader in workforce management for years while Ultimate Software provides a solid core human capital and payroll solution with significant integrated functionalities that jointly should be complementary to companies seeking an integrated human capital management solution with solid service support. The only challenge presently lurking is how this new organization is going to align their overall team to take on challengers who have been aggressively marketing while the corporate realignment and new configuration of the joint company transpires.

Figure 1

Assessing the merger in M&A terms, the deal itself reflects two very similar companies:

- Ownership (each firm is owned by the same Private Equity-led consortium of investors). This includes Hellman & Friedman as principal investor with additional investments from Blackstone, GIA, Canada Pension Plan Investments and JMI Equity Revenues ($1.5B for Kronos and $1.4B USD for Ultimate).

- Strong employee culture with recognition for both companies from Fortune, Great Places to Work, Glassdoor and others.

- Recognized as leaders in HR Technology Solutions by analysts like Gartner, Forrester, Nucleus, and others.

- Headcount (each firm has approximately 6,000 employees).

- Global presence (each firm has a very strong U.S. & Canadian presence with varying degrees of support for non-North American locales). The relative weakness in global presence represents a priority the new company wants to address.

- Leadership recognized for strong people and customer focus.

- Multiple product lines and even various products within the same sector.

- Similar target market.

- Mix of legacy products and new cloud solutions.

PRODUCT DEVELOPMENT

Kronos is strongly established in the workforce management and time and attendance niche while UltiPro has been a steady and mature integrated human capital/payroll solution for the last two decades. What is next for the new company will be interesting as Workforce Dimensions from Kronos should emerge as the de facto standard in workforce management, but existing Kronos partnerships with ADP and SAP/SuccessFactors could be worth watching due to the new Ultimate presence. UltiPro is a solid HCM/Payroll platform but needs improvement in the Talent Management space, so it will be worthy of note to see where additional development spend occurs in the next few years.

Ultimate also expects to continue to expand their platform agnostic solutions in HR Service Delivery and Sentiment Analysis. HR Service Delivery by PeopleDoc provides HR Service Delivery options for File Management, HR Analytics, Case Management and Knowledge Management regardless of HCM solution. Perception is the relatively new Ultimate purchase of an Artificial Intelligence (AI) powered Sentiment Analysis and Employee Survey tool that provides broad employee insights irrespective of HCM platform.

In addition to the breadth of functional solutions, the new Ultimate/Kronos company provides a range of system options for firms from enterprise to small business with potential capabilities from both legacy companies. Ultimate Software’s software-as-a-service offering, UltiPro, has enjoyed deep adoption in retail, service, and restaurant industries and has been a strong competitor to Workday, Oracle Cloud, and SAP/SuccessFactors. Kronos never realized that same adoption with their HCM solution (Workforce Ready), but small to midsize organizations may find Workforce Ready perfect for their needs. On the flip side Kronos has been a stalwart in workforce management solutions and their Workforce Dimensions solution may be a perfect complement to the UltiPro suite. What remains unseen is how this all gets bundled and presented to potential customers. Whatever occurs, increased choices, broader integration, and expanded analytics translate to improved customer value.

LEADERSHIP POSITION

With both Kronos and Ultimate recognized as top tier human capital solutions, it will be noteworthy to see what gets rebranded, repurposed, or redesigned and how the market responds (See Figure 2). A significant factor in this transition for Kronos and Ultimate Software is how the merger timing has coincided with the Coronavirus pandemic and a slumping economic forecast for most businesses. Slow net new sales across all HCM vendors has been predictable, but the strength of the new combined company pitch will have a sizable impact on how quickly sales achieve anticipated levels of success and the joint venture company reestablishes their position as an industry leader.

Figure 2

In discussions with Greg Swick, Chief Sales Officer for Ultimate Software, and Jody Kaminski, Chief Marketing Officer, both cited best-in-class technology supported by two companies with exceptional culture and employee satisfaction experience. Swick commented that “by combining our product offering, we are offering our customers a differentiated, best-in-class, full-suite solution that integrates the strongest functionality across all areas of HR and meets the diverse needs of all our customers.” Kaminski added that this is “two amazing companies with very little overlap. We both are really focused on the customer experience. Our senior leadership team has been together a long time and we take care of people. Ultimate was more unstructured while Kronos was more formal in their processes, but the outcome was the same. Continuing to serve our customers as partners and treating our employees as our most valuable resource will not change. “

GEOGRAPHIC FOCUS

North America has been friendly territory for both Ultimate Software and Kronos, but continued global expansion is critical to the growth each anticipates as a joint entity. Kronos has established recognition with large, global clients with complex time management needs and Ultimate has been trying to build on the European client-base of their PeopleDoc HR Service delivery business that was purchased in 2018. Entering new markets is imperative for any HR technology firm. In 2018, Ultimate took a leap with its purchase of document management platform PeopleDoc just as employee engagement and experience were gaining attention. By 2019, in a first-ever deviation from bundling integrated products, Ultimate allowed stand-alone sales for PeopleDoc and Perception, its engagement survey with built-in sentiment analysis, in hopes it would help its Experience Suite continue to penetrate new markets. As buyers seek portal, workflow, and CRM tools to extend HCM SaaS products, Ultimate has remained laser-focused on providing integrated solutions that optimize the employee experience. There is no such tool in Kronos’ portfolio.

Continuing to leverage Kronos, PeopleDoc and Perception are all ingredients in plans for on-going global presence and the future growth anticipated from the new company. On one hand with only a 2% overlap in customers (~400 customers shared between their combined 22,900 customers) there appears to be ample development opportunity to market Workforce Dimensions for workforce management and/or UltiPro for integrated HCM, but the additional strength of PeopleDoc (HR Service Delivery) and Perceptions expands the potential geography of this sales efforts.

GRAND ASPIRATIONS

Both companies have award-winning cultures rich in people values, but that does not mean they will be compatible with each other or that they will succeed as a joint entity. Retaining people and passion will be key to maintaining the trust and customer-centric energy for which these companies are known. Jody Kaminsky observed, “we know that people are being stressed due to ownership of “their systems” and desire to keep ‘their culture’. They are finding things lacking – connection, information, consistency, and overall context, but these things are in the works. I think we moved the needle on how we connected with people and this true partnership is something we care about deeply.” Exciting times lie ahead for Ultimate and Kronos, although competitors will be salivating at the chance to cast doubt and foreshadow disruption.

Merging of cultures is tough despite all the similarities between the two companies and there will still be real and perceived winners and losers in this merger. A significant key to the success of this merger rests on one of the key value propositions of the combined company itself – the ability to engage the employee fully. The employee of their customers and the employee of the joint company are both significant audiences for what comes next. Here are some of the key initiatives already in place.

Keep the Keepers — The loss of key people, post-merger, is not only inevitable, it also poses a concern to both companies when key people with significant skills and relationships decide this is an opportune time to move on. Stock options, Headhunters and competitors will all erode some of the best and brightest in both firms, so the challenge will be to retain people critical to the on-going identity and operations of the new company.

Build Synergies — To make a deal’s economics work, the combined firm needs to cross-sell solutions (e.g., sell Kronos workforce management applications and time clocks to Ultimate customers and market the UltiPro suite to Kronos clients) to drive up revenues. The combined firm can better coordinate R&D efforts allowing two firms to take advantage of one investment (i.e., Do both firms need to pour millions into developing their own new machine learning based analytics or and updated talent acquisition engine?). The combined firm should also get economies of scale in how it completes common functions like Finance and HR regardless of whether than occurs in Lowell or Weston. The faster the combined firm can identify and realize deal synergy opportunities, the healthier the balance sheet and the happier the shareholders will be.

Standardization — Integration teams must design the new ways that work will get done in a company of 12,000+. New policies and procedures will be required and need to be signed off. Customers, suppliers, employees, and others will be impacted, and they must get trained on or be communicated on these changes no matter how significant. Deploying these solutions will necessarily look different as well as the combined company looks to increase utilization of partners in solution deployment and support.

New company and New Name — Kronos and Ultimate will continue to be marketable identities, but the new company requires a new name to match this union (a new name is anticipated by Fall 2020). The merger was announced under the internal tagline: People Inspired. That is a start, but real branding and recognized reputation takes time, repetition, clarity, and public acknowledgement to make a difference.

Longer-term, the new owners will be challenged to come up with another incentive program that keeps the best and brightest at the new company. The luxury of 100% employer paid health care, sizable 401(k) matching and perks that contributed to this being one of the “Best Places to Work” will be hard to maintain, but even more important will be fostering an identity for the new organization that reinforces this company is still all about people. As a company, the technology is in place to provide value to customers throughout the world, but the differentiator is cultivating a culture of UltiPeeps and Kronites that customers see as customer AND employee centric.

Finally, this merger portends significant change for the HCM industry itself. Economic crises will require all companies to optimize operational efficiencies and many will not survive the next three years of change and disruption. The human capital technology leaders of tomorrow will find a way to maximize information, insights, and inputs from employees to deliver the best to customers across the globe.